Perform quantitative analysis on complex option strategies using Excel VBA.

Trader

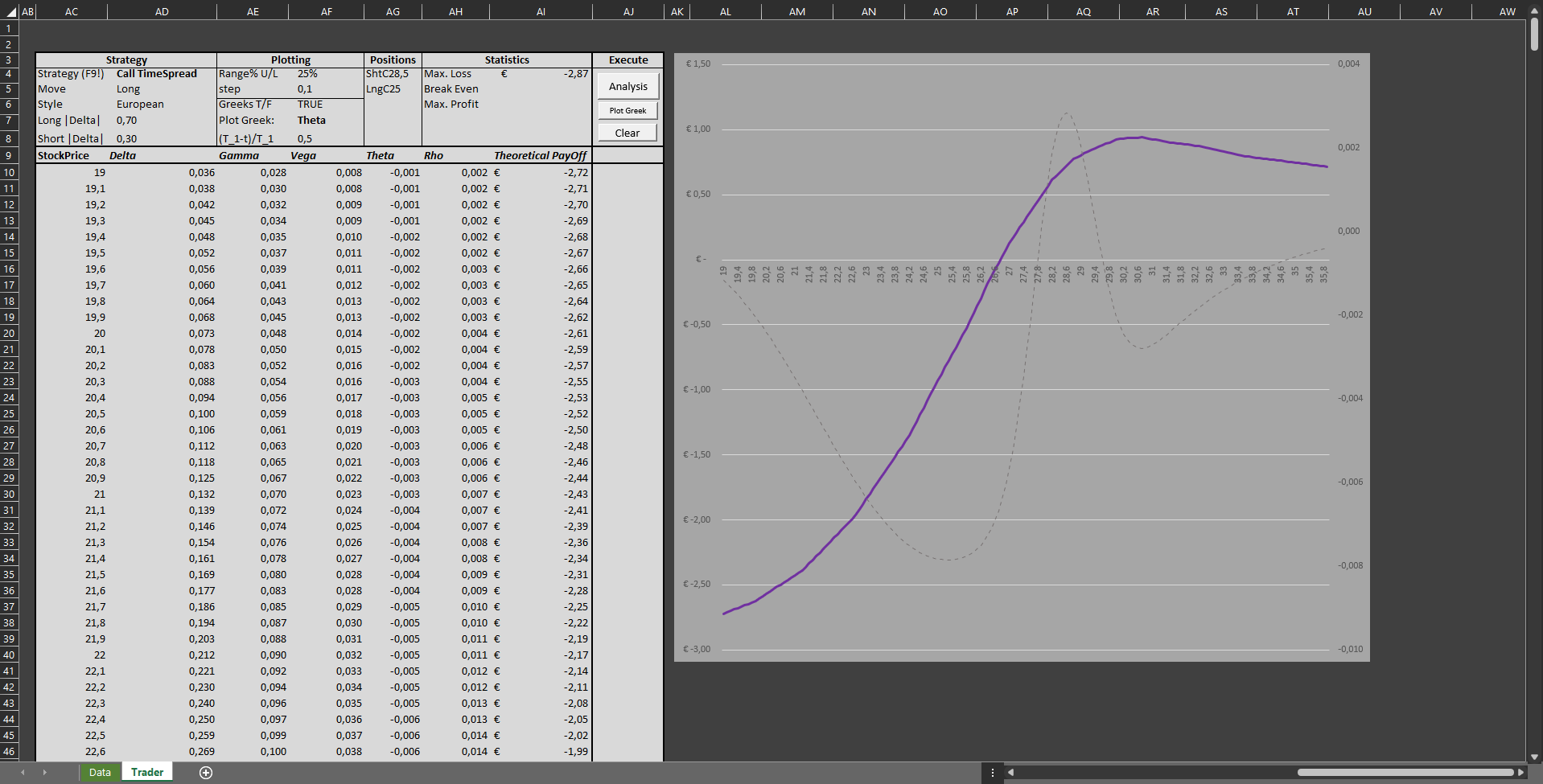

OptionVBA allows for quick analyses on complex option strategies. Users can simulate pay-offs, compute and visualize the greeks and time-decay of quoted vanilla options. Furthermore, users can quickly analyse pay-offs and Greeks for long and short positions in European and American style call -, put -, and butterfly spreads, condors, strangles, and straddles. Specific legs are found based on user-preferred deltas. Functionality exists to model DdeltaDtime and DgammaDtime directly by setting the result parameter in the BinTree function to 6 or 7 respectively. The code is available in the module BinomialTreeFunctions. Other higher order Greeks can be estimated using this function indirectly.

Standard

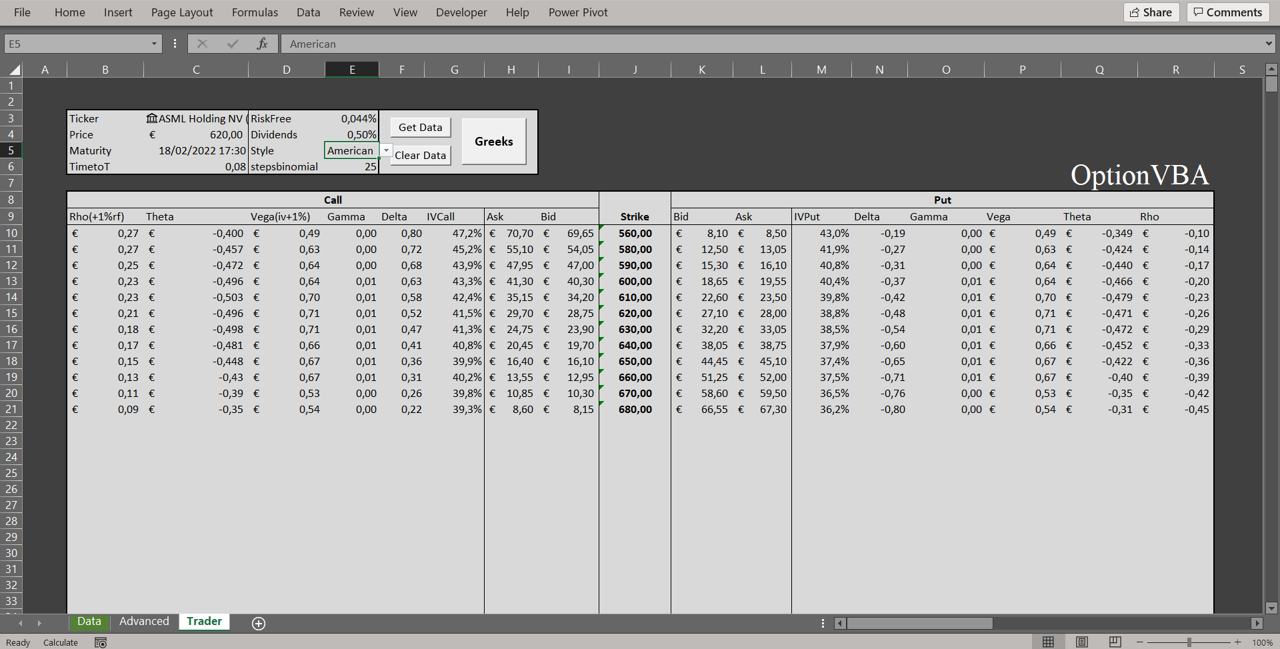

Standard functionalities include automatic cleaning of your copy-pasted options quotes from DeGiro, and calculating implied volatilities and Greeks for both American and European style put and call contracts. Manually specifying contract parameters is also possible. Implied volatilities are found using the bisection method. European style contracts are analysed using the Black and Scholes formulae. American style contracts are analysed using a binomial tree algorithm.

Download

With this version of OptionVBA you immediately gain access to all functionalities. Click on the Logo image below if you wish to download OptionVBA.

Contact

Feel free to contact me if you have questions, suggestions, or experience errors.

E-mail:

Impression